Broker-Dealer

FPB Bank has a broker-dealer license which allows us to offer differentiated and sophisticated investment products.

-

Investment Advisory

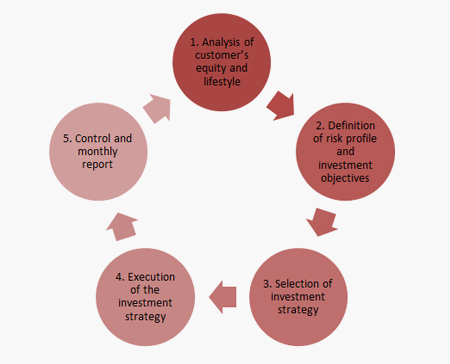

FPB Bank offers investment advisory, based in the experience and knowledge of our team, providing assets allocation ideas, which give the necessary support to the customer, to make the best decisions and meet their investment objectives.

Our team of bankers and brokers are trained to assist customers in choosing investments that best fit their net worth, risk profile, investment horizon and expected return.

-

Brokerage Services

Coverage

FPB Bank has relationships with many international banks, giving us the ability to acquire investments in US Dollars and other major currencies.

Professionalism

The portfolio is managed by professional brokers, who will guide you to achieve your expected results.

Competitiveness

FPB Bank allows access to a wide range of investment alternatives, including: Bonds, Stocks, Funds and Options at reasonable fees.

Strategic Alliances

In 2013, FPB Bank established an alliance with Saxo Bank, headquartered in Denmark, licensed and regulated by the European Union, to provide custody and investment services to its customers.

Saxo Bank is operating in 20 countries, including Spain, Brazil, Uruguay, United Kingdom, France, Switzerland and Panama. Its international reputation is based on the excellence of their service, wide range of products and its advanced platforms, which have been awarded for their speed of execution, security and transparency.

Introducer Agreement to Saxo Bank: FPB Bank has an “Introducer Broker” agreement with Saxo Bank, which allows us to offer our selected customers the ability to open an investment account with this institution on their behalf.

Saxo Bank is a leading global trading bank and portfolios management that provides a wide range of financial services to its customers that includes corporations, financial institutions, professional investors and high net worth clients.

It provides access to major financial markets. Through its platform, clients can trade shares, futures, options, CFDs, ETFs and other financial products covering over 25,000 assets.

-

Custody Services

FPB Bank has an integrated and efficient custody platform. The Bank sends confirmations of all transactions into your account the following day.

You can obtain all the information from your custody account through FPB Bank’s internet banking, where you can scroll through the history of your transactions and see all the details concerning executed transactions, as well as other important information regarding the securities, such as issuer, amount of principal and interest, maturity, dates of execution and settlement, date of the next interest payment, etc. Pending transactions are also available, displaying all transactions to be settled, as well as debits and credits projected into the Main Current Account. In addition, liquid securities are quoted daily through an interface with Bloomberg Pricing Service.

To supplement this information, you will receive upon request a monthly consolidated accounts statement. These statements contain detailed information about the client's custody account, showing all the securities owned, by type of asset. The securities information is available in great detail and the multicurrency feature makes it possible for the customer to invest in securities denominated in different currencies, as well as to display the total in various currencies.

-

Foreign Exchange

FPB Bank’s Foreign Exchange Desk has the experience and means that allow our customers to participate in this increasingly important market. Whether you want to convert currencies or hedge your equity against currency risk, our brokers in FPB Bank can advise you efficiently.

FPB Bank uses an integrated banking system, with state-of-the-art navigation tools.

FPB Bank accepts several types of collaterals for a loan, can be cash, real estate or securities.